1 Chapter 1 Trinity R. Gabato

Image Source: Mitchell, O. S. (2017, April 10). How Financial Knowledge Drives Wealth Inequality.https://blogs.wsj.com/experts/2017/04/09/how-financial-knowledge-drives-wealth-inequality/

The Racial Wealth Gap: The Barrier to Financial Literacy for People of Color

INTRODUCTION

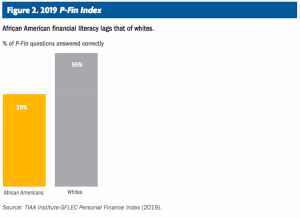

“The Black Middle-Class is far more fragile and has much less wealth than the White Middle-Class…For every dollar of wealth in the average white family in America, the typical Black family has just a little more than a nickel”(Herbert 2017), Bob Herbert made this clear at the beginning of the PBS documentary called Against All Odds. Even in 2017 Black families have much less wealth than white families, but yet are still expected to and are perceived to have the same opportunities as White families. The racial wealth gap and financial literacy are glanced over and talked about in America but do people really know how bad it is or even want to fix it? Many believe that financial literacy may be the key to help eradicate the racial wealth gap, but it may not be the resolution since the racial wealth gap is more structurally embedded than American society may want to believe. According to a study by the TIAA Institute and the Global Financial Literacy Excellence Center (GFLEC) at the George Washington University School of Business (GWSB), African Americans especially African American women did poorly on a Personal Finance Index in comparison to Whites. The study showed that: “Financial literacy is significantly higher among men. There is a seven percentage point difference between African American men and women in the percentage of index questions answered correctly”(Yakoboski, Lusardi, Hasler 2020). Not only are financial literacy rates among African American Men low in comparison to Whites, but African American Women’s rates are even lower.

This past summer I watched many hours of Youtube about investing, credit, and retirement. A lot of things that are not taught in school. Last year, I did a checklist in class that had a list of things you knew based on which social class you were a part of. I realized I had little to no information about financial literacy while many of my classmates did. Although I learned so much about financial literacy, I eventually realized that it takes money to make money. Due to this, I would like to better understand how financial literacy is taught and not taught within lower-income families and communities. Now, in our modern technology age, financial literacy has become more accessible through Youtube and different apps. Although it has become more accessible than ever the racial wealth gap is still prominent in the United States.

In this paper, I will explore how the racial wealth gap has played a big role in our current socio-economic state and how financial literacy plays a role in the racial wealth gap. Financial literacy plays a big role in how people of color can gain access to capital. With red-lining, job discrimination, wage gaps, and access to education, it has been incredibly difficult for low-income people of color to build wealth. The wealth gap between people of color and women of color have been incredibly disproportionate to white families. I would like to understand if financial literacy plays a role in the building of wealth and how we can examine the issues with the work by classical is this translated from past sociologists. I am interested in tieing Marxist theory and W.E.B Dubois’s analysis of race, to better understand how financial resources and opportunities affect different socio-economic groups. I would also like to understand how the American dream values and the media may play a role in revealing the economic thinking and values that many people of color hold. In understanding how the racial wealth gap affects financial literacy rates, this paper will examine how those contemporary issues related to classical sociological theory. Marx, Engels, and Bourdieu understood how capitalism is in favor of the bourgeoisie. W.E.B Du Bois was aware of the structural inequalities that played a role in social inequality and generational wealth. Marx and Engels both saw the power that capital holds and how it is used to hold systems of inequality up. Weber saw through the labor systems that allowed these inequalities to appear and for the bourgeoisie to upkeep their power. All classical sociologists mentioned in the paper give insight into the capitalist system that holds people of color back from achieving equal wealth and therefore equal financial literacy.

W.E.B Du Bois Color Line to Examine the Level of Financial Literacy

Du Bois’s concept of the color line can be applied to examine the level of financial literacy in the United States. Americans are driven by the idea of achieving wealth through the “American Dream” and believe that if you work hard enough you can achieve anything you set your mind to. Du Bois saw through this American Dream and showcased the hardships and inequalities for people of color and colonized peoples face in many of his writings. In On the Meaning of Race, he argued that: “To be a poor man is hard, but to be a poor race in a land of dollars is the very bottom of hardship”(Dubois 1897: 24). Dubois highlights that it is not just individuals’ inequality, but structural and racial inequalities that shape America. In Du Bois’s chapter “On Education”, he emphasizes how access to education and careers for people of color were slim to none. The only two occupations that were available to many Black male college graduates were teachers and preachers. Du Bois also explains how many women were constrained to the household and child-bearing.

The Veil: The Product of the Color Line

The color line explained by Du Bois (1903) also plays a big role in how social inequality is internalized and used to keep White Americans in power. The color line is a prominent concept in his book, The Souls of Black Folk. The color line is the idea that people of color do not have the same opportunities and access to resources as white people. This in turn limits how people of color can see their true potential within themselves. The color line described by Du Bois not only applies in the States but to Du Bois it applies globally. Due to colonization, eurocentrism and westernization are valued more in many other countries. Another concept Du Bois explained is the veil: the idea that Black Americans are only able to see themselves in the ways in which the white majority portrays them and this also stunts the way they can achieve their full potential (Du Bois 1903). The structural racism in American makes it very difficult for Black Americans especially to achieve and get access to the things White Americans have access to.

An Elitist Agenda

Marx and Engels in the Communist Manifesto make it clear that the current capitalistic systems support the bourgeoisie, and not the individual worker, which has led to many determinants in society. Capital is at the center of their analysis, “Capital is therefore not only personal; it is a social power”. (Marx and Engels 1848: 23). Marx and Engels explain that capital and property are created by exploiting the low-wage laborer and in now way enriches the laborer’s life. Communist capital and property would support all people while not supporting the bourgeoisie who have exploited low-wage workers to gain something they call their own hard-earned capital. Marx and Engels understood that: “Labor does not only produce commodities; it produces itself and the worker as a commodity and it does so to the same extent as it produces commodities in general” (Marx 1844: 133) In the current capitalist system workers are not seen as individuals and the system does not benefit low-wage workers, but makes them a commodity to the bourgeoisie. They are not seen as individuals with needs, but as workers supporting systems of power. Marx and Engels also emphasize the importance of making sure that the ruling class does not have influence the education system. The ruling class not only has a say in education but family as well. The system of marriage is used constantly to further the ruling class’s agenda and to keep wealth within a certain group. Not only does marriage keep wealth in certain groups, but also makes it as if women are solely for the use of capital and property, “The bourgeois sees his wife a mere instrument of production”(Marx 1848: 24). Based on Marx and Engels’s arguments everything is usually dictated by the ruling class and capital is held by the bourgeoisie.

The Guiding Work Ethic

Weber believed that capitalism was driven by founding Protestant values. Protestantism is the belief that God already has a plan for you and thus you must work hard on Earth to prove to God your worth, this is what Weber labeled as the Protestant work ethic. Weber explains that one must conform to the capitalistic system or be shunned from it, “It forces the individual, in so far as he is involved in the system of market relationships, to conform to capitalistic rules of action”(Weber 1905: 21). Weber talks about an economic survival of the fittest, to survive one must adapt to the systems of capitalism. In order to survive one must work endlessly, but Weber explains that one does not work to work, but to make money. That man is driven by the acquisition of money in the capitalist world, “Man is dominated by the making of money, by acquisition as the ultimate purpose of his life” (Weber 1905:18). He explains that people only work because they are poor which allows companies to take advantage of their labor. Not only does one have to conform to these systems, but when they do they may face an extreme amount of individualism that can lead to loneliness. Weber also believed that systems of rationality allowed big corporations and businesses to dehumanize the laborer in order to gain the most profitable. Lastly, Weber also highlights that education and capital are highly reliant on inherited wealth.

What Everyone Believes is Equal, But the Few Have

Pierre Bourdieu in Forms of Capital, explains the many forms of capital that the bourgeois class holds and the ways in which capital functions within society. Bourdieu makes is clear that capital is not just given but passed on and accumulated, “Capital, which, in its objectified or embodied forms, takes time to accumulate and which, as a potential capacity to produce profits and to reproduce itself and identical or expanded form, contains a tendency to resist and it’s being, is force inscribed in the objectivity of things so that everything is not equally possible or impossible” (Bourdieu 1986: 241-242) Bourdieu explains that since capital is accumulated over time money has the possibility of making more money from its self. Thus, eloquently explaining the idea “It takes money to make money”. One form of capital that Bourdieu emphasizes is cultural capital in the mind and body or the embodied state. Embodied cultural capital is not as easily seen as economic capital thus being more disguised and serves more as a type of symbolic capital. Bourdieu explains that there is a type of cultural competence and the illiteracy of cultural capital among the many allows for the few that have the cultural capital to profit. Cultural capital is not easily learned because it is usually passed on by family members and certain forms of socialization (Bourdieu 1986).

Economic Recession Uncovers the Truth

Throughout American history, we can see that people of color are constantly suffering under the rule of wealthy White America. Slavery and racism have not been stopped but suddenly transformed, keeping people of color especially Black Americans from achieving equality. During the most recent economic downturns, people of color have suffered immensely. In 2008, many people of color fell victim to bank’s offering Ninja Loans. Ninja loans stand for No Income, No Job, and No Assets Loans. These types of loans make it easy for people who are not financially literate to fall victim to these loans. The Center for Responsible Lending explains “Among recent borrowers, we estimate that nearly 8% of both African Americans and Latinos have lost their homes to foreclosures, compared to 4.5% of Whites”(Gruenstein Bocian et al. 2010). House foreclosures during 2008 were disproportionately affecting Black and Brown communities across the United States. Most recently, the Covid-19 pandemic is similarly disproportionately affecting people of color and leaving the wealthy untouched. During the current pandemic, we can see the financial disparity between wealthy White Americans and the essential workforce that is predominately people of color. Oxfam America shares how striking this issue is:

These profits will be paid to shareholders, a group of largely white, rich men who already control the vast majority of our country’s corporate stock. The wealthiest 10 percent of Americans own 87 percent of all corporate stock in the US, compared to less than 1 percent of shares owned by the bottom half. Racial disparities are even more stark. Oxfam estimates that 9 out of every 10 dollars of pandemic profits will end up with white Americans in 2020. Black and Latinx families—already disproportionately affected by COVID-19—receive only 16 cents each. (OXFAM America 2020)

The data shows how horrific the racial wealth gap still is even today in 2020. If 87 percent of all corporate stock is owned by the wealthiest 10 percent then during this pandemic the wealthiest 10 percent got richer while many people are struggling to pay rent. Billionaires and Millionaires could have made money off of stock booms from the Virus Vaccine with companies like Moderna or Pfitzer. This data also reflects that there is a small percentage of people who are constantly profiting no matter what is happening in the economy.

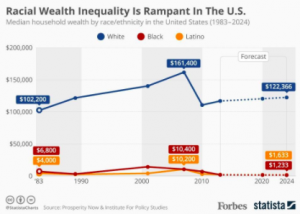

The Samuel Du Bois Cook Center for Social Inequality at Duke University in 2018 conducted a study debunking many myths surrounding the racial wealth gap. The report explained that many Black households have little net worth to buy and accumulate capital. The report explained, “Black households in the lowest 20 percent of the income distribution essentially have zero net worth, while the poorest white families have on average $15,000 – $18,000 in net worth”(Darity Jr., Hamilton, Paul, Aja, Price, Moore, and Chiopris 2018: 3). Based on the statistic above, even the poorest white households hold around 15,000 times more wealth than poor black households. Another report by Forbes showed the immense racial wealth gap by median household incomes:

Graph 1: Racial Wealth Gap in the United States and the predicted Racial Wealth Gap until 2024. (McCarthy 2017)

Based on Graph 1, the Racial Wealth Gap is even starker and bigger than some may expect. According to the predicted median household incomes, the gap between Black and Latino households and White households will become even scarier for people of color, and even worse over time. The Samuel DuBois Cook Center for Social Inequality report also explains that while financial literacy can be useful that is only the case when there are finances to manage (Darity Jr., et al. 2018). The report states, “There is no magical way to transform no wealth into great wealth simply by learning more about how to manage one’s monetary resources”(Darity Jr., et al. 2018: 23). Although financial literacy is important it can only be helpful when people of color are given the opportunity to gain wealth.

Even when African Americans have access to resources, limited financial literacy prevents them from making the best use of them to build wealth. For instance, the report also emphasizes that many Black Americans choose to opt into 401k’s a lot less than White Americans. Despite the fact that the report argues that financial literacy can only be helpful with finances, 401k’s play a big role in the accumulation of wealth and of saving wealth, and therefore learning about these things would play a role in how Black Americans make financial choices. According to a 2020 study, African Americans had lower rates of financial literacy in comparison to their White counterparts.

Graph 2: TIAA Institute and GFLEC Institute display that based upon a Personal Finance Index, African Americans scored way lower than their White counterparts. (Yakoboski, Lusardi, Hasler 2020)

Although financial literacy rates may be lower for African Americans, it can not be always used as a tool when there are no finances to be literate about, Due to the structural inequalities many households of color are unable to save and thus are unable to use financial literacy as a tool, “Two out of three households of color do not possess enough savings to sustain themselves for three months if their income were disrupted”(Brown and Robinson 2016: 5). While closing the racial wealth gap may seem like an individual responsibility to many Americans, it is a structural and governmental problem. Elizabeth Warren, a former Democratic presidential candidate shared in one of her speeches, “Families of color face a path that is steeper and rockier, a path made even harder by the impact of generations of discrimination,”(Newkirk 2019). Although many leaders are trying to close the racial wealth gap there are many against racial equality and helping close this gap. America has a long way and hundreds of years to make up for to help close the racial wealth gap for Black and Brown Americans.

Structural Racism Makes Financial Literacy Not a Possibility for People of Color

Financial Literacy not being an option for many people of color is not only due to the hundreds of years that stopped people of color from accumulating wealth, but also the systems and structures that stop this from happening today. Racism and structural racism has been persistent due to the majority of people in power being white and predominantly men (Lu et al., 2020). Even today in 2020 with trends like affirmative action people of color are still getting unequal pay in comparison to the White men who are doing the same positions. According to a 2020 study:

The gender wage gap is magnified by a racial and ethnic earnings gap. For all occupations, Hispanic women working full-time have the lowest median earnings at $642 per week (just 56 percent of the median weekly earnings of non-Hispanic White men at $1,147. Black women have median weekly earnings of $704, which is 61.4 percent of the median weekly earnings of White men (Hegewisch and Barsi 2020: 5)

Since women of color and people of color are being paid much less than their White counterparts they are even more likely to have a harder time-saving money. Not only is saving harder when you are making so much less, but also makes it so people of color have to rely more on loans and credit to try and succeed to gain access to many opportunities that are just handed to well-off White households. The American Dream and many wealthy white families emphasize that education can get you far in American society and can be one way to escape the cycle of poverty. Many African Americans who get an education in order to follow this dream end up with student loans which digs them deeper into debt, African Americans are more likely than whites to carry student loan debt (41% and 21%, respectively)”(Yakoboski, Lusardi, Hasler 2020: 1). Credit cards accumulate even more interest which means even more debt for people of color, “Among credit card holders, 68% of African Americans engage in expensive credit card behaviors compared with 36% of whites. Such behavior includes paying only the minimum due, incurring late payment fees, incurring over-limit fees, and taking cash advances”(Yakoboski, Lusardi, Hasler 2020: 1). Overall, Financial Literacy among African Americans is much lower than White Americans which thus leads to more and more individual economic issues among people of color.

How the Classical Sociologists Shed Light on The Racial Wealth Gap and Financial Literacy

Du Bois (1903) continually highlighted that Black Americans were at the bottom of the economic system due to the color line. This color line stopped Black Americans and people of color from gaining access to education, jobs, and accumulating capital. Since 1897, when DuBois published his groundbreaking study The Philadelphia Negro, not much has changed for Black and Brown people. The racial wealth gap remains prominent and many people still do not feel like there needs to be a change. Recently, there was a prop on the Ballot, Proposition 16 that could have helped close this gap with affirmative action and allow for diversity to be a factor in employment, but people still voted no. Although there has been more access to higher education for people of color since 1897, according to Duke University, Black households still hold much less net worth in comparison to White households (Darity, W et al. 2018).

Marx and Engels (1848) both emphasize the importance of abolishing bourgeois private property because only a small percentage of people will get the privilege and money to experience private property. They also argue that private property is the bourgeois profiting off the cheap laborer while the laborer gets nothing in return. The inheritance of property plays a big role in the racial wealth gap. Due to redlining, discrimination, and many laws against people of color getting the opportunity to acquire private property, many people of color were unable to accumulate capital over time. This plays a big role in the disparities between the net worth of Black and White households. Weber (1905) also emphasized that capital was dependent on inherited wealth. When American capitalist systems have been structured against people of color, they are not able to pass down any wealth because there were so many barriers for them to gain wealth in the first place.

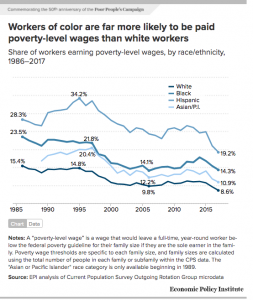

Due to the racial wealth gap and barriers of access people of color have not been able to have the finances in the first place to have the need or want to be financially literate. Not only does the amount of wealth affect financial literacy for people of color but Marx and Engels pointed out that the ruling class dictates the type of education systems for all. The majority of the wealthiest 10% and the ruling class is wealthy white men. Therefore, the ruling class has no incentive to include financial literacy in public education because this would possibly affect access to capital and wealth. If many people of color are unable to gain access to systems of higher education due to lack of inherited wealth they are left doing many low-wage jobs. Weber also points out that the laborer is many times dehumanized in rational systems in order to gain profit when participating in these cruel capitalist systems. These low-wage jobs many times do not offer 401k plans, insurance plans, constant hours, and much more. The minimum wage has also not increased in the States since 1980 (U.S. Department of Labor) and therefore the majority of people who are suffering from this static minimum wage are low-wage workers who are largely people of color (Cooper 2018).

Graph 2: Based on a study from the Economic Policy Institute by David Cooper in 2018 we can see that there are twice as many Black low-wage workers than White Wage Workers (Cooper 2018)

Low-wage workers have to live pay-check by pay-check usually due to the low-wage and long hours (Hegewisch and Barsi 2020). Therefore, it is easy to assume that many are unable to save and have the fiscal resources to risk money on the stock market. The stock market and investing include a lot of risk and time. It is very easy to lose all of your money on the market and when you are living paycheck to paycheck one cannot afford to risk their money at all. Reading about the stock market also takes a lot of time. Credit also plays a big role in financial literacy, but when one needs capital many usually seek credit as a source of rescue. This can lead to a lot of debt and possible bankruptcy in the future. The media and past presidents have made it seem as if people are taking advantage of the social security systems and thus they are not necessary. Instead of providing more resources for people of color who have suffered from systems of inequality, the ruling class decides who can accumulate wealth and keep it. When one is barely able to put food on the table and systems are dictated by the ruling class financial literacy is put on the back burner as something not applicable to their current financial situation.

Financial literacy may seem easily accessible now with technology, but for many people of color, it is more difficult than it may seem. With hundreds of years of systems of oppression and inequality, people of color and Black Americans especially are suffering while White America upholds structural racism. Financial Literacy has become a form of cultural capital as Bourdieu (1986) described that is passed on through family members and close social groups. Not only does is financial literacy passed down, but also to be literate about finances you have to have finances in the first place. Du Bois, Marx, Engels, Weber, and Bourdieu all saw the detriments of the system of capitalism and the inequalities that dictate many of our days to day lives. Even a hundred years later, their sociological theories are still relevant today and apply to the systems of inequality we can see today. The color line coined by Du Bois (1903) has not been erased, but instead redrawn. Although there are opportunities like affirmative action and financial aid from colleges and universities, the price of them has increased immensely over the past years. The increase in price makes many low-income students have to take out thousands of dollars in loans at the age of 18 and not know teaching them how to handle the debt out of college. The systems of inequality and racial wealth gap make financial literacy only seem attainable for the wealthy and as a tool that needs to be reshaped in order to help close the wealth gap.

Conclusion

This paper summarized the data of the racial wealth gap trying to understand how stark and big the gap truly is. Finding that White households hold almost ten times the wealth as Black households (McCarthy 2017). Due to this stark racial wealth gap, The Samuel DuBois Cook Center for Social Inequality (Darity Jr. 2018) report made it clear that without finances in the first place it is hard for people of color to be financially literate. Therefore, the TIAA Report (Yakoboski et al. 2020) displayed how financially illiterate Black Americans are in comparison to their White counterparts and how this translates into more debt for people of color.

The American Dream lives in the imagination of many Americans with hopes that financial wealth and stability can be achievable when one works as hard as possible. Due to structural racism and systems set up against many people of color, especially Black Americans it is difficult to see that the American Dream is available to everyone in America. Since African Americans arrived on the shores of America, Black people have been working for free and allowing for White Americans to accumulate wealth. This accumulation of wealth over time with hundreds of years of racism and barriers to people of color has led to the huge racial wealth gap we have today. Although financial literacy may not be the one and only way to solve the Racial Wealth Gap it is a start. Acknowledging the barriers to financial literacy and why the tools may not be helpful to low-income people of color helps us understand the structural racism that impedes these tools from being useful.

In many ways, the bourgeois described by Marx and Engels (1848) has shaped and still dictate today’s systems. The color line and the veil described by Du Bois (1903) still play a role in racial inequality and how Black Americans move through society even a hundred years later. Weber’s concept of the Proletariat work ethic still reigns true and is even more prevalent after the Reagan administration. The American Dream has not died and still motivates many Americans every day to work hard in a system that is built for the wealthy. When I walked into this project I believed that Financial Literacy needs to be incorporated into public education. Although technology has made financial literacy easier to access, people of color are still working in a system that benefits the wealthiest. Weber explained in The Protestant Ethic and the Spirit of Capitalism, that if you do not take part in capitalism you are thrown out on the street (Weber 1905). This is vividly true in systems of social security. Systems of financial literacy not only perpetuate systems of capitalism but are also treated privately and personally just like Marx and Engels (1848) described capital.

REFERENCES

Bourdieu, P. (1986). The forms of capital. In: Richardson, J., Handbook of Theory and Research for the Sociology of Education.

Brown, C., & Robinson, L. (2016). Breaking the Cycle: From Poverty to Financial Security for All. Retrieved 2020, from https://www.policylink.org/sites/default/files/BreakingTheCycle_0.pdf

Cooper, D. (2018). Workers of color are far more likely to be paid poverty-level wages than white workers. Economic Policy Institute. https://www.epi.org/blog/workers-of-color-are-far-more-likely-to-be-paid-poverty-level-wages-than-white-workers/.

Darity, W., Jr., Hamilton, D., Paul, M., Aja, A., Price, A., & Moore, A. (2018). What We Get Wrong About Closing the Racial Wealth Gap. Insight Center for Community Economic Development.

Du Bois, W. E. B. 1868-1963, The Souls of Black Folk: Essays and Sketches. Chicago, A. G. McClurg, 1903. New York: Johnson Reprint Corp, 1968.

DuBois. W.E.B. 2004. “The Conservation of Races,” “Of Our Spiritual Strivings,” “Does Race Antagonism Serve Any Good Purpose?,’ “Africa and the Slave Trade,” “The Souls of White Folk,” “Should the Negro Be Encouraged to Seek Cultural Equality,” “The

Concept of Race,” “The Negro and the Warsaw Ghetto,” “Color Prejudice,” “Anti-Semitism,” “Prospect of a World Without Racial Conflict,” “The Talented Tenth” in Zuckerman, Phil (ed.). The Social Theory of W.E.B. DuBois. Thousand Oaks / London / New Delhi: SAGE Publications

Gruenstein Bocian, D., Li, W., & Ernst, K. S. (2010, June 18). Foreclosures by Race and Ethnicity: The Demographics of a Crisis. Retrieved 2020, from https://www.responsiblelending.org/mortgage-lending/research-analysis/foreclosures-by-race-and-ethnicity.pdf

Hegewisch, A., & Barsi, Z. (2020, November 2). The Gender Wage Gap: 2019 Earnings Differences by Race and Ethnicity. IWPR 2020. https://iwpr.org/iwpr-issues/employment-and-earnings/the-gender-wage-gap-2019-earnings-differences-by-race-and-ethnicity/.

Herbert, B. (2017). Against All Odds – Chasing the Dream. https://www.pbs.org/wnet/chasing-the-dream/films/against-all-odds/.

History of Federal Minimum Wage Rates Under the Fair Labor Standards Act, 1938 – 2009. U.S. Department of Labor Seal. https://www.dol.gov/agencies/whd/minimum-wage/history/chart.

Lu, D., Huang, J., Seshagiri, A., Park, H., & Griggs, T. (2020, September 10). Faces of Power: 80% Are White, Even as U.S. Becomes More Diverse. https://www.nytimes.com/interactive/2020/09/09/us/powerful-people-race-us.html.

Marx, Karl and Friedrich Engels. 1848. The Communist Manifesto

McCarthy, N. (2017, September 15). Racial Wealth Inequality In The U.S. Is Rampant [Infographic]. Forbes. https://www.forbes.com/sites/niallmccarthy/2017/09/14/racial-wealth-inequality-in-the-u-s-is-rampant-infographic/?sh=26a7131a34e8.

Newkirk II, V. R. (2019, January 22). The Racial Wealth Gap Could Become a 2020 Litmus Test. Retrieved November 16, 2020, from https://www.theatlantic.com/politics/archive/2019/01/new-litmus-test-2020-racial-wealth-gap/579823/

OXFAM America. 2020. Pandemic Profits Exposed. OXFAM Media Briefing. July 22, 2020

Weber, Max. 2001 [1905]. The Protestant Ethic and the Spirit of Capitalism. New York: Routledge.

Yakoboski P. J., Lusardi, A., & Hasler, A. (2020). Financial literacy, wellness and resilience among African Americans. TIAA Institute. https://www.tiaainstitute.org/about/news/financial-literacy-wellness-and-resilience-among-african-americans.